Security Center

Security Center

Scams, identity theft, viruses, worms and credit card fraud are happening more frequently today than ever before. Each article in our security center contains current and relevant information to help you avoid being a victim of fraud and identity theft and keeps you on top of both current and past, but ever-present scams.

Current Scams:

Below are some of the frequent scams we have been made aware of. Please report any suspicious link.

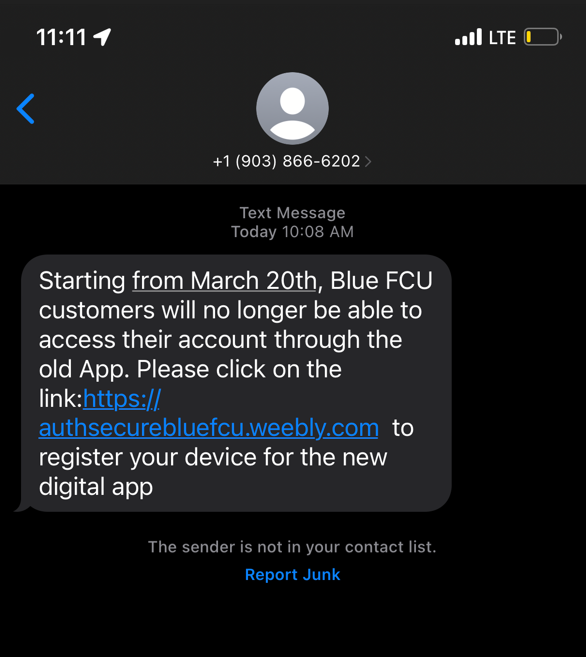

Texting Scam: Blue FCU Online Banking Application Shutdown

Some members have been receiving text messages stating the following:

“Starting from [Date], Blue FCU customers will no longer be able to access their account through the old App. Please click on the link: [suspicious link] to register your device for the new digital app”

If you receive this message or a similar message, please DO NOT click the link and submit a report to Blue.

Screen Shot:

Did you receive a suspicious link?

Please report it by clicking the link below and filling out our online report form.

To report unauthorized charges on a debit card, please call 1-888-514-1404.

To report unauthorized charges on a credit card, please call 1-855-341-4650.

How Blue Protects You

We implement various security controls on our website and online banking system to protect your sensitive information. These controls include, but not limited to:

- Anti-virus and anti-malware protection to detect and prevent viruses and malicious software.

- Fraud monitoring to detect and prevent fraudulent activities.

- Website encryption, which scrambles data so only the intended recipient can read it. Once a server session is established on an https secure page, the user and the server are in a secured environment.

- Usernames and Passwords, our online banking requires a username and a strong, complex password.

- Multifactor authentication, which requires you to provide two or more forms of identification before accessing your account.

- Secure Messaging, you can securely message us within online banking.

- Blue’s firewall protects against unauthorized access to our systems by blocking malicious internet traffic.

The content below is provided by a third party, courtesy of Blue.

Protecting Yourself From Fraud

Fraud can happen to anyone, anywhere, anytime. Cleaning up after ID Theft or account compromise can be both costly and time-consuming.

Ways Your Identity Can Be Stolen

- Theft of your wallet or purse.

- Providing a “change of address” to divert your mail to someone else.

- Spam of phishing emails/phone calls where victims are convinced to provide their personal information to clear up account issues.

- Skimming your information with card skimmers usually at an ATM or Gas Pump.

- Stealing items thrown away in your trash or stealing mail from your mailbox.

What to Do if You Feel You Have Been Compromised

- Close all financial accounts i.e. credit cards and bank accounts immediately.

- Place a fraud alert with all 3 credit bureaus and immediately obtain copies of your credit reports to identify unauthorized accounts.

- Contact the DMV or any other Government ID source to report the theft and obtain new documents. Additionally, they can add an alert to keep anyone else from being able to obtain a license or other identification in your name.

Tips to Prevent Fraud

- Keep your passwords unique and use different passwords for different sites.

- Never share your password.

- Change your Password regularly (every 30-45days).

- Keep your computer protection software up-to-date.

- Don’t carry anything with you that you don’t use regularly i.e. credit/debit cards, social security card, etc. Additionally, keep a record of items in your purse/wallet in a safe place.

- Check your credit report regularly. You can check your credit from all 3 bureaus for free once a year at www.annualcreditreport.com.

- Take advantage of shred events. Most financial institutions have these events annually. NEVER place personal information in the garbage; not even an address!

- Know when your mail regularly runs and use mail deposit boxes at the post office rather than a place where anyone has access to your outgoing mail.

- Be careful of what you share on social media; don’t make it easy for criminals by letting everyone know you are not at home.

- Never give out personal information by phone; most of the time if a legitimate company is contacting you, they already have the verifying information that they need. If they are asking for a full card number or full social; simply hang up. You can always call the company with the phone number listed in the phone book to verify if it is a legitimate call.

- If it is too good to be true; most likely it is! You should never have to send money to receive money.

- Be careful of email scams. Do not open or click on any email or link that you are unsure of. If you did not enter a lottery, chances are you are not going to win. If you place an ad on Craigslist, do not release goods or payment without meeting in person; it is best to answer/advertise locally. Know who you are dealing with. When in doubt check it out. Finally, be careful of Mystery Shop and other online job scams. Again, no one should ask you to send them money so you can earn money.

- Don’t answer calls from unknown number; if it is a true call, they will leave a voicemail.

- If asked to hit a button to stop receiving calls, just hang up.

- You can file a complaint with the Federal Trade Commission if a number is provided via caller ID.

- Ask your phone provider if they provide a robocall blocking service.

- Register your number on the National Do Not Call Registry.

- Carefully monitor all accounts and statements including phone bills, cable and internet bills for any unauthorized charges.

- If you receive a call from your financial institution claiming an issue with your account, let them know that you need to call them back and call the number listed in the phone book. We will never ask for personal information when we call.

Protect yourself with debit card alerts

The CardNav mobile app helps you set up balance and purchase alerts on your Blue debit card.

Always stay aware of what is happening with your account.

Security Alerts & Scams

Phone Phishing Scam

UPDATE: January 2022

Blue Federal Credit Union has been made aware of a phone phishing scam that is affecting our members. Some members are receiving phone calls spoofing the Blue 1-800 number. This person states they are from our fraud department and they need to verify information. After reading the member’s last four numbers of the card, they proceed to ask for the CVV/CVC code on the back of the card. THIS IS A SCAM. Do not provide secure information to anyone without verifying the source.

PLEASE NOTE: Blue Federal Credit Union will never ask for personal or secure information over the phone unless you have initiated the call and confirmed your identity.

What you can do to protect yourself:

- If you suspect an impersonator, hang up the phone.

- If you have concerns about your account, log into online banking and verify your purchases.

- If you suspect their may be fraudulent activity on your account, contact us right away and we will begin your claims process.

Email Fraud Alert

UPDATE: January 2022

Blue Federal Credit Union has been made aware of a phone phishing scam that is affecting our members. Some members are receiving phone calls spoofing the Blue 1-800 number. This person states they are from our fraud department and they need to verify information. After reading the member’s last four numbers of the card, they proceed to ask for the CVV/CVC code on the back of the card. THIS IS A SCAM. Do not provide secure information to anyone without verifying the source.

PLEASE NOTE: Blue Federal Credit Union will never ask for personal or secure information over the phone unless you have initiated the call and confirmed your identity.

What you can do to protect yourself:

- If you suspect an impersonator, hang up the phone.

- If you have concerns about your account, log into online banking and verify your purchases.

- If you suspect their may be fraudulent activity on your account, contact us right away and we will begin your claims process.

Phone Scam Alert

December 10, 2019

**FRAUD ALERT**

We have been notified that some members are receiving calls from a Blue impersonator asking for a password and/or a code that was just sent to them. THIS IS A SCAM!

Blue will never call you just to ask for a password, sensitive data, or a code. If you call us, THEN we will ask you for your password or code so we can verify it’s your account. If you’re in doubt, simply call us at 1-800-368-9328 and we can check to see your history. You can also log into online or mobile banking to check your account activity, along with our CardNav mobile app.

PLEASE NOTE: Blue Federal Credit Union will never ask for personal or secure information over the phone unless you have initiated the call and confirmed your identity.

Phone Scams

“Can you hear me”: Scammer asks questions in effort to get you to say YES (i.e. Are you the man/woman of the house? Can you hear me? Etc.) Scammers record the YES and can use it to pay bills, make charges on your phone bill and purchase products in your name. When the charges are discovered, the scammer uses the recorded YES as proof of authorization.

“Computer Repair” Refund: The scam works like this: Several months after the purchase of software or computer “repair”, someone might call to offer refunds as part of a customer satisfaction campaign or the caller may say that the company is going out of business and providing refunds for “warranties” and other services. In either case, the scammers eventually want access to bank or credit card information. They will ask you to log in to your online banking while they remote in (share your computer screen) to make sure the “refund” has been deposited. Then they inform you that they gave you too much and need you to send a portion of it back via Western Union. They are transferring, unknowingly to the victim, from the victim’s own accounts to make the “refund” appear so the victim loses their own money if they were to comply.

Sweet Heart Scams

These scammers prey on elderly or recently widowed/divorced individuals. Once trust is gained by convincing the victim they are “in love,” the scammer will then begin making up stories of desperation in order to get the victim to send them some money. Most of the time these relationships happen on Social Media or Online Dating sites. Scammers also convince their victims that they want to meet. They will send you the money that you need to buy plane tickets. Usually this is done by using Mobile Deposit to deposit a check into your account. In many cases, they will convince the victim to set up online banking and ask for those credentials because they have earned your “trust.” The check, of course, is fraudulent and in most cases, the two never meet in person.

Internet Loan Scams

These are Quick Cash scams. Usually, the victim is looking for small unsecured loans that they are unable to get through their financial institution. Most of the time, they are in desperate need. They begin looking online or clicking on links within social media sites to obtain the loan. The victim receives an email of approval asking for bank information and sometimes online banking information so that a deposit can be made. The online banking information is used to deposit a check via Mobile Banking into the victim’s account. They are then asked to wire some of all of the funds back to test their loyalty or ability to pay. The deposited check later comes back as fraud leaving a negative balance in the victim’s account.

Mystery Shop/Online Jobs

Victims are sent a packet containing a check with instructions for a “Mystery Shop” assignment. The victim is asked to first deposit the check into their bank account and wait no more than 48 hours for the check to clear. They are then asked to wire those funds back at Walmart then rate their experience with Money Gram. The check later returns as fraudulent leaving a negative balance in the victim’s account.

Craigslist

Victims are contacted regarding items they have listed on Craigslist. The “buyer” is very interested and is hoping for a very quick transaction; they are even willing to pay you to ship your items. They send you a check for more than your asking price. They tell you to use a portion to ship your item to them. You comply, the check later returns as fraudulent.

Text Code Fraud

January 10, 2019

**FRAUD ALERT**

We have been notified that some members are receiving text messages from a Blue impersonator stating something is wrong with their debit card. THIS IS A SCAM!

Blue will never ask you to provide sensitive details like this via text, email or phone. If you’re in doubt, simply call us at 1-800-368-9328 and we can check to see if something is wrong with your card. You can also log into online or mobile banking to check your account activity, along with our CardNav mobile app.

PLEASE NOTE: Blue Federal Credit Union will never ask for personal or secure information over the phone unless you have initiated the call and confirmed your identity.

What you can do to protect yourself:

Never give out your SSN, DOB or Card Number unless your source as been verified.

Download the CardNav mobile and and sign up for legitimate text message alerts for when purchases are made on your debit card.

If you have concerns about your account, log into online banking and verify your purchases.

If you suspect there may be fraudulent activity on your account, contact us right away and we will begin your claims process.

Other Resources

- IRS 1-877-438-4338

- Credit Bureaus:

- Experian 888-397-3742

- Equifax 800-685-1111

- Transunion 800-916-8800

- Opt Out Numbers 888-567-8688 (Credit Offers)

- Do Not Call 888-382-1222 (Telemarketing)

- You can go to https://ftc.gov to file a complaint.